Why time is running out for Germany's green hydrogen industry

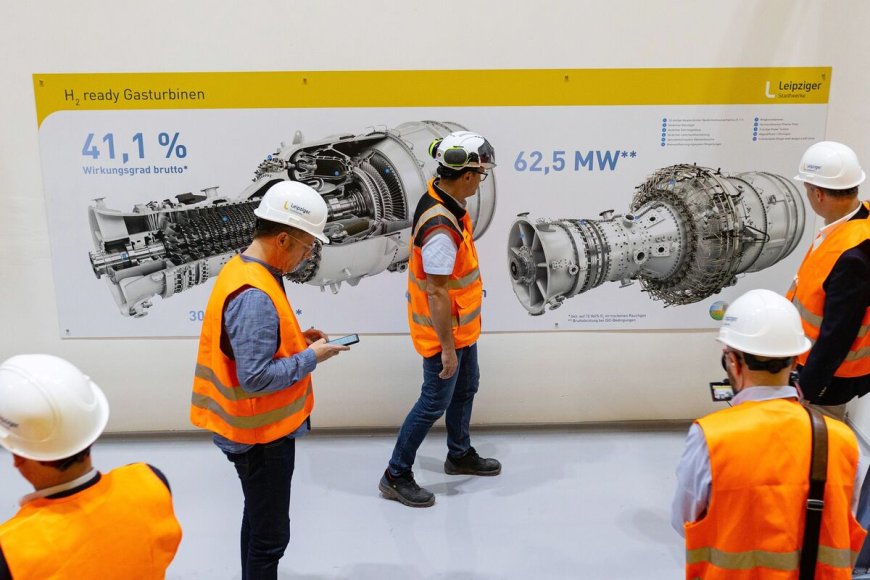

These devices split water into oxygen and hydrogen. Those manufactured by Quest One use proton exchange membranes to achieve this.

In a quiet, unassuming factory near Hamburg, in northern Germany, industrial robots prepare to assemble the components of electrolyzers.

The robotic arms that build Quest One's electrolyzers are faster and more reliable than the humans they replaced.

However, this speed and efficiency are not yet fully necessary, as the volume of orders for electrolyzers is far below the plant's capacity.

The mismatch between supply and demand is clearly visible in Quest One's workforce.

This Hamburg factory can accommodate almost twice as many employees. However, earlier this year, the company had to lay off 20% of its employees in Germany.

“The market itself isn’t recovering organically,” acknowledges Nima Pegemanyfar, executive vice president of customer operations at Quest One. “The problem is demand, not supply.”

Demand is low, in part, because green hydrogen (hydrogen produced by electrolysis using renewable electricity) remains expensive compared to the fossil fuels used to produce other types of hydrogen.

Low-emission hydrogen production accounts for less than 1% of global hydrogen production. This includes both green hydrogen and blue hydrogen, which is produced from natural gas by capturing and storing the resulting carbon dioxide.

Larger scale would help reduce the cost of green hydrogen, but many projects remain small-scale.

Quest One expects that, over time, green hydrogen production will cost €4 ($4.60; £3.50) per kilogram, roughly half the current price in Germany, according to the company.

The gap isn’t limited to supply and demand.

There could also be a disconnect between the sectors where green hydrogen is most urgently needed (for example, for high-temperature applications in the chemical, steel, and shipping industries) and the less competitive but still debated use cases.

Christian Stöcker, a professor of communication at the Hamburg University of Applied Sciences, is frustrated by the attention given to hydrogen for building heating and car fuel. He emphasizes that these are extremely inefficient compared to heat pumps and electrification.

Quest One is part of the Volkswagen Group, which is reportedly considering selling its subsidiary, Everllence, which would then own Quest One.

Volkswagen neither confirmed nor denied this information to the BBC, nor did it specify whether it had any other plans related to green hydrogen. A spokesperson stated: "We are currently reviewing strategic options for Everllence."

What's Your Reaction?